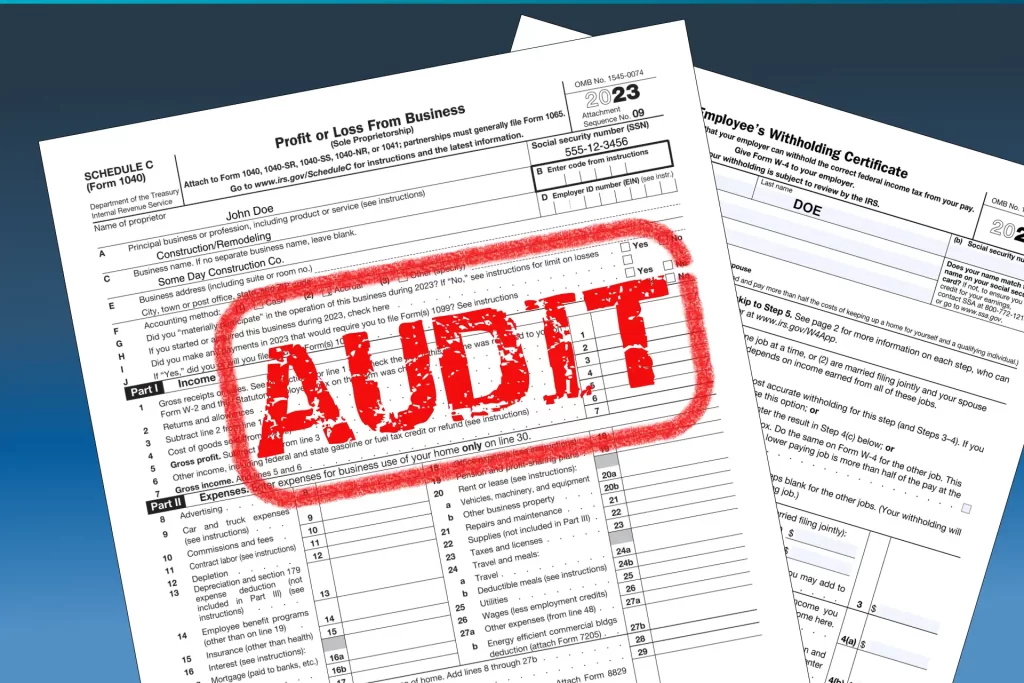

Audits & Examinations

Two dreaded words – IRS AUDIT. We often have nightmares about the thought of an IRS audit or examination.

Audits cause fear and concern because they require you to explain important facets of your financial situation. You have to explain your income and substantiate the expenses and deductions claimed on your tax return. However, in many cases, receiving an IRS notice informing you of an audit does not always mean you’ve made a mistake or submitted your return dishonestly. Often audits, if handled correctly, can result in a refund or acceptance of a return without any changes.

Information on IRS Audits & Examinations

What can increase my odds of being audited?

- Being a high-income taxpayer who is involved in intricate real estate transactions or who run their own real estate or construction business

- Taxpayers who report their business activities on schedule C of their 1040 form

Should you be facing an IRS examination, arm yourself with a tax professional or Enrolled Agent who knows your rights and can guide you through the examination process.

WHAT ARE THE ODDS OF OF BEING SELECTED FOR AN AUDIT?

FUN FACT! The odds of an individual income tax return being selected for examination are low! Less than 1.5% of individual tax returns are audited, according to the US Treasury Department.

Who gets audited?

- The IRS selects individual tax returns randomly or by examining refund or credit claims by matching documents like a W-2 and 1099 forms against income tax returns

- The IRS also uses a computerized system called DIF. DIF basically assigns a numerical weight to specific items on a tax return. If the total DIF score exceeds a certain amount, the tax return is flagged for review and potential audit.

- How does the Examination typically work?

- IRS sends written notification to a taxpayer that a return has been selected for audit

- The notice indicates which items are being questioned and what records the taxpayer needs to provide to resolve the questioned items

- Some audits are handled by mail and are called Correspondence Audits. A taxpayer may be able to resolve disputed tax return items by providing appropriate documents via mail or some may meet with a local IRS agent for an office audit.

- Correspondence by mail may settle more quickly than an office audit, but no general rule exists that either is more beneficial to the taxpayer. However switching from a correspondence audit to an office audit may widen the scope of an investigation.

- The examination concludes with the IRS agent either proposing an adjustment or accepting the tax return as originally filed. If an adjustment is suggested, the taxpayer can pay the additional tax or appeal the decision.

If you have received an IRS Notice of Audit, contact us regarding our affordable IRS Audit and Examination Defense and Representation.